D CEO Commercial Real Estate

Reports on North Texas Commercial Property Deals

Commercial Real Estate

‘Dallas Will Welcome You’: Get to Know NTCAR’s Newest Hall of Fame Inductees

Bill Vanderstraaten and Scott Rohrman were inducted as hall of fame members, while Jack Fraker and Robert Grunnah earned recognition for their lifetime achievements.

Advertisement

Trending

4

Advertisement

Latest

Commercial Real Estate

‘Dallas Will Welcome You’: Get to Know NTCAR’s Newest Hall of Fame Inductees

Bill Vanderstraaten and Scott Rohrman were inducted as hall of fame members, while Jack Fraker and Robert Grunnah earned recognition for their lifetime achievements.

Commercial Real Estate

What’s the Key to Attracting Talent? Three Frisco Developments Offer Answers

Developers behind Frisco Station and Fields reveal detailed updates—and city officials provide a sneak peek of redevelopment plans for Frisco's downtown.

Commercial Real Estate

Checking in on HEB’s Plans for the Old Albertson’s in Uptown

The property at Lemmon and McKinney remains undeveloped despite years of announcements and renderings that depicted a $295 million, 25-story mixed use development anchored by a Central Market. What's going on?

By Will Maddox

Commercial Real Estate

Serra Real Estate Capital, Dallas County Open Mixed-Use Parking Structure in Downtown Dallas

The current property is a prelude to further on-site development that is anticipated in conjunction with the $3.7 billion Kay Bailey Hutchison Convention Center expansion.

Commercial Real Estate

What Commercial Real Estate Leaders Can Learn From an Economic Downturn

Difficult economic times allow you to prepare for the good times, says Citadel Partners Managing Partner Scott Jessen.

By Scott Jessen

Advertisement

Latest

Party Pics

Scenes from D CEO’s 2024 Commercial Real Estate Awards

More than 500 of North Texas' top dealmakers gathered to celebrate the year's most notable projects and the people who made them happen.

By D CEO Staff

Commercial Real Estate

Former Mayor Tom Leppert: Let’s Get Back on Track, Dallas

The city has an opportunity to lead the charge in becoming a more connected and efficient America, writes the former public official and construction company CEO.

By Tom Leppert

Commercial Real Estate

Why Mikial Onu Is Pursuing Opportunities in Southern Dallas with The Adaline

This week marks the groundbreaking of the 12-acre mixed-use development by Onu Ventures near the intersection of Interstates 45 and 20.

Dallas 500

Meet the Dallas 500: Karla Smith, SRS Real Estate Partners

The executive vice president and principal with SRS Real Estate Partners’ Dallas/Fort Worth office shares her best advice, her proudest moment and her hopes for the future of real estate

By D CEO Staff

Commercial Real Estate

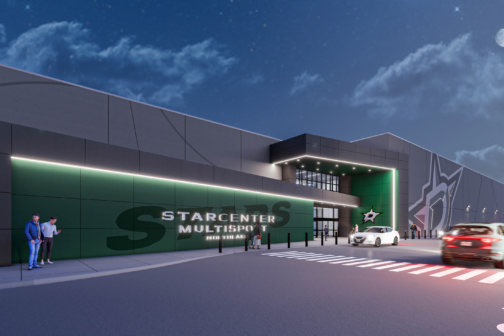

Dallas Stars to Build $45 Million Multipurpose Athletic Facility in Northlake

The NHL team continues to pursue multi-sport opportunities, building on announced facilities in Lewisville and Farmers Branch.