D CEO Commercial Real Estate

Reports on North Texas Commercial Property Deals

Party Pics

Scenes from D CEO’s 2024 Commercial Real Estate Awards

More than 500 of North Texas' top dealmakers gathered to celebrate the year's most notable projects and the people who made them happen.

By D CEO Staff

Advertisement

Trending

7

Advertisement

Latest

Party Pics

Scenes from D CEO’s 2024 Commercial Real Estate Awards

More than 500 of North Texas' top dealmakers gathered to celebrate the year's most notable projects and the people who made them happen.

By D CEO Staff

Commercial Real Estate

Former Mayor Tom Leppert: Let’s Get Back on Track, Dallas

The city has an opportunity to lead the charge in becoming a more connected and efficient America, writes the former public official and construction company CEO.

By Tom Leppert

Commercial Real Estate

Why Mikial Onu Is Pursuing Opportunities in Southern Dallas with The Adaline

This week marks the groundbreaking of the 12-acre mixed-use development by Onu Ventures near the intersection of Interstates 45 and 20.

Dallas 500

Meet the Dallas 500: Karla Smith, SRS Real Estate Partners

The executive vice president and principal with SRS Real Estate Partners’ Dallas/Fort Worth office shares her best advice, her proudest moment and her hopes for the future of real estate

By D CEO Staff

Commercial Real Estate

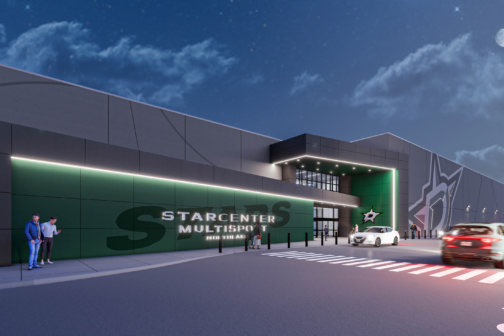

Dallas Stars to Build $45 Million Multipurpose Athletic Facility in Northlake

The NHL team continues to pursue multi-sport opportunities, building on announced facilities in Lewisville and Farmers Branch.

Advertisement

Latest

Commercial Real Estate

First Look: The New Ritz-Carlton Dallas, Las Colinas

The rebranded resort, which is in the midst of a $55 million renovation, features a new Knife Italian restaurant from celebrity chef John Tesar.

Business

How Dallas Newcomer Stephen Kotler Plans to Grow Douglas Elliman’s Local Market Share

After arriving from Los Angeles, the regional CEO aims to turn the firm into his new hometown’s top residential brokerage.

By Ben Swanger

Commercial Real Estate

Craig Hall on Why He’s Reinventing His Frisco Office Park

Investing $7 billion in his 162-acre development is a big bet. But for Hall, the end product is just as much about what you'll feel as what you'll see.

Executive Travel

A First Look at the New Crescent Fort Worth, and How to Spend a Weekend There

Crescent Real Estate Chairman John Goff shares his vision for the charming new hospitality anchor in Fort Worth's Cultural District—and how he landed the deal to develop it.

By Ben Swanger

Commercial Real Estate

Behind the $22 Million Verdict Against Gene Phillips’ Company

Daniel Moos, the former president and CEO of Pillar Income Asset Management, sued his former employer after he was fired and claimed the company refused to pay him what he was owed.

By Will Maddox